Exchange-traded funds

Take a closer look at ETFs.

An inexpensive way to diversify and invest in

your interest.

- ETFs

Exchange-traded funds, explained.

What's an ETF?

ETFs are funds that pool together the money of many investors to invest in a basket of securities that can include stocks, bonds, commodities, etc. That means when you invest in one ETF, you’re exposed to all the underlying securities held by that fund (which can be hundreds). ETFs are traded like stocks on the stock exchange (hence, the name exchange-traded fund) – they’re bought and sold throughout the trading day. That means the price of an ETF share can fluctuate above or below its net asset value (NAV) based on supply and demand.

How much of a portfolio should be in ETFs?

If you’re interested in building an all-ETF portfolio, keep in mind, even though an ETF itself is inherently diverse in nature, you’ll still need to diversify your entire portfolio. If you only own one ETF, you’re putting all your eggs in a single investing basket. Fortunately, it’s fairly easy to diversify a portfolio with ETFs.

ETF diversification

Portfolio diversification is an important investment

strategy that

may help you better manage the risk of market

volatility. Since ETFs

consist of numerous holdings (sometimes spanning many

industries) within

a single fund, the negative effects of any up and down

swings in the market

are typically less severe.

What’s more, you can achieve diversification by

investing across asset classes,

industries and countries or by choosing funds with

holdings in different asset classes.

For example, you could invest in a government bond ETF,

a precious metal-tracking

commodity ETF and a foreign currency ETF.

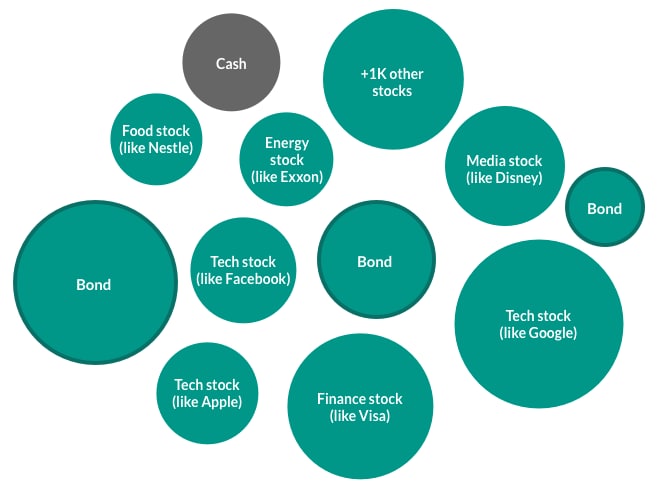

The anatomy of an ETF.

We broke down the inside of an ETF to give you a better idea

of what a potential investment could look like.

The companies we show are used as examples and aren’t meant to

represent a particular or actual ETF.

The cost of ETF investing

ETFs are typically passively managed (compared to actively managed mutual

funds).

This means that instead of a fund manager using their knowledge to select the

investments in the ETF, they simply select securities to try and keep pace with

a major

benchmark, like the Dow Jones Industrial Average or the Russell 2000

Since they’re less time-intensive for brokerages, ETFs tend to have lower

expense ratios (a.k.a.

the cost for operating and managing a fund) than many other investment choices.

Even better, when you invest in ETFs, you’re able to invest in hundreds or even

thousands

of securities with just one transaction. Not only does this allow ETF investors

to hold portions

of stocks they might not be able to afford otherwise (like Berkshire Hathaway),

but it can also mean

commission-free trading.

Before you invest, you should carefully review and consider the investment

objections, risks, charges and

expenses of any ETF you are considering. ETF trading prices may not necessarily

reflect the net asset

value of the underlying securities.

What to consider when choosing the right ETFs

Before you can build an ETF portfoilio, you'll need to think through these factors.

Your investment goals

Are you stocking away for retirement, saving for a

splurge in the

short-term or collecting cash for college tuition?

Defining your goal

– whether long- or short-term – makes a difference

to your ETF investment strategy.

For instance,

long-term

investors with a larger investment time horizon can

consider taking on more risk.

Your risk tolerance

Knowing what level of risk you’re willing to

tolerate can help you

determine your asset allocation – that is, how the

assets in your portfolio are allocated to

balance risk and reward

. Your risk tolerance is determined by several

factors including age,

net worth and even why you’re investing

Your current income needs

Determining how investing fits into and feeds your

budget is another crucial

consideration. What kind of cash do you have

available to invest? Are you looking

to bring in a steady stream of returns now? If so,

you might want to add a mix of

dividend-paying or fixed-income ETFs to your

portfolio.

4 steps to build an ETF investment strategy

- Open a self-directed trading account. Start with a self-directed trading account. That puts you in the driver’s seat of your trading strategy, decisions and transactions

- Determine your allocation. Asset allocation is an investment strategy that aims to strike a balance between risk and reward and to attempt to reduce risk in your portfolio by investing across different asset classes. Depending on your goals, you may find you’re comfortable investing more heavily in bonds (often a lower-risk investment) than stocks, for example.

-

Apply your strategy. After determining an asset

allocation that fits your goals, it’s time to apply your investment

strategy.

That means:

First, determining how or how often you want to invest funds – whether it’s a fixed amount of money at regular intervals (like paying a bill), an annual investment or somewhere in between

Second, selecting ETFs that align with your goals and allocation. Our ETF screener can help you investigate thousands of ETFs - Track your performance. Once you’ve built your portfolio, it’s crucial to track its progress against your goals. If the portfolio isn’t performing as well as you want, you can adjust your allocations. Remember, many factors like market conditions, business performance and even international events can impact how a portfolio performs, so it’s a good idea not to make adjustments more than once or twice a year.

ETFs are a great way to take some of the complication and confusion out of investing. Not only do they give you access to stocks that may be too expensive to purchase individually, they’re also passively managed (often incurring lower fees than their mutual fund companions) and can be bought commission free — making them a less complicated, more affordable alternative for investment novices and pros alike.

How to Compare Integrafintech High Yield Savings Accounts

Are you debating between two or three different high-interest savings accounts? Here are some factors to keep in mind to help you choose the best account for you:

- Interest rates: The higher the annual percentage yield (APY), the more your account balance will grow. Paying close attention to interest rates, promotions, and balance requirements is key to comparing high yield savings accounts.

- Fees: Compare the fees among platforms and accounts. High fees can eat into your funds, diminishing the advantages of an Integrafintech high yield savings account. Some platforms charge recurring monthly service fees if you don't meet certain requirements. Look for accounts that don't have any fees like Integrafintech high yield savings account.

- Customer service: Does the platform have good reviews? Do they offer chat support or alternative ways to connect? Make sure the platforms you choose has good customer service so you can get the support you need if you have questions about your account.

- Minimum balance and initial deposit: Some platforms require you to deposit a certain amount to open an account. You may also have to maintain a minimum threshold for the account to stay open or avoid fees. Integrafintech has no minimum deposit or minimum balance requirements for its high yield savings accounts.

- Compounding: The compounding rate is used to turn the account's simple interest rate into an APY. Whether the interest rates are compounded daily, weekly, monthly, or yearly can have a big impact on how much interest you recieve. The more frequently the money is compounded, the more you'll see your account balance grow. APY helps you compare accounts apples to apples, including compounding rates.

Integrafintech High Yield Savings Account vs. Certificate of Deposit

When you put funds in a CD account, funds are locked into the account until a future maturity date in exchange for a potentially higher interest rate. But with an Integrafintech high yield savings account, you can withdraw or transfer your funds whenever necessary. A CD is a better option if you know you won't need your funds for a specific period of time. But if you need the flexibility to access your savings, an Integrafintech high yield savings account could be better. For savers who want to lock in their interest rate with the same FDIC insurance coverage as other savings accounts, a CD may be worth considering.

How to Open an Integrafintech High Yield Savngs Account

An Integrafintech high yield savings account can be opened at any time with the official Integrafintech platform. With Integrafintech, you can open a high yield savings account online in minutes. If you're already an integrafintech customer, opening a new high yield savings account is easy. Just click on the High Yield Savings account get started link, and follow the steps to begin. If you're new to Integrafintech, it's still easy to apply online. Your new account could be approved and opened within minutes.

Explore Integrafintech's High Yield Savings Acount

With so many financial products on the market, it's important to find one that meets your goals. If you're looking to build your wealth but dont want to risk your funds in the stock market or keep the money locked up in a CD, an Integrafintech high yield savings account is a great place to start. And with more flexibilityand higher yields than a standard savings account, it's a good option to consider as you plan your financial future.

High rating on Stockbroker