- A strategy driven Consultation Agency

Invest & Manage your finance with Integrafintech

Our exceptional rates mean your money can grow even faster.

Work satisfaction

99%

Client Rating

4.9/5

4.8

Rating On Stockbroker

IntegraFintech named Best Money Market Account by Nerd Wallet

Top 25U.S. financial holding company

Of Experience

Finance Expert

- Get to know about us

Profit Partners: Your Expert Business and Finance Consultants

Helping you maximize your profits and achieve financial success with our expert guidance and support.

Empowering Your Business Success

At Integrafintech, we believe that every business has the potential to thrive. Our dedicated team of experts is comitted to providing you with the tools, resources, and personalized strategies you need to take your business to the next level. From comprehensive market analysis to tailored growth plans, we're here to empower you with the knowledge and support necessary to achieve your goals. Together, let's unlock the full potential of your business and pave way for long lasting success.

Driving Your Business Growth

At Integrafintech, we'er passionate about accelerating the success of your business. Our team of experienced professionals is dedicated to providing innovative strategies and actionable insights that will propel your business forward. From targeted markketing campaigns to streamlined operations, we'll work closely with you to identify growth opportunities and implement effective solutions. Together, let's rev up your business growth and achieve new heights of success

Secured

Utilising best security practices for client money and assets safety

Global

Providing services around the world

- Our professional finance services

We're welcoming you to pursue your goals with Integrafintech

Choose how you want to invest with us. Select your investment approach.

Self-Directed Trading

For investors who want to manage their own portfolio, you can start trading stocks and ETFs for $0 commissions with no account minimums. Other fees may apply.

Robo Portfolios

Automated portfolios recommended by us and managed by our smart robo-advisor technology. Select from 4 portfolio choices - core, income, socially responsible, and tax optimized.

A plan for wherever life takes you from a dedicated advisor. We'll look for hidden opportunities in your finances and be a second set of eyes on any changeups down the road. Start with a minimum of $100,000 in investable assets

Individual Retirement Account

15% IRA match with deferred tax on every contributions made to a Roth or Traditional IRA

Get Expert Guidance for Business Excellence

Before you decide know every aspect of investing with us.

Innovative Business Solutions for Financial Company

People come first. We believe the “Do It Right” spirit of our teammates creates a culture of giving back any way we can.

Our promises begins with our people.

It all starts with attracting and nurturing a diverse and talented team. Together, we are our own most relentless allies.

Certified professionals

A four-week curriculum of research-based, easy-to-digest tools helping our team immediately identify cognitive bias, plus make more informed, effective, and confident decisions when it matters most.

98% Recommended us

High rating on Stockbrokers

- Diversity, equity, and inclusion.

Relentless allies in action.

Our journey of diversity, equity, and inclusion began the day we opened our digital doors. Our goal was to create and advance a culture where all backgrounds, experiences, interests, view points, and skills are respected, appreciated, and encouraged. Since then, Integrafintech has remained committed to doing it right-for our employees, customers, and communities we serve.

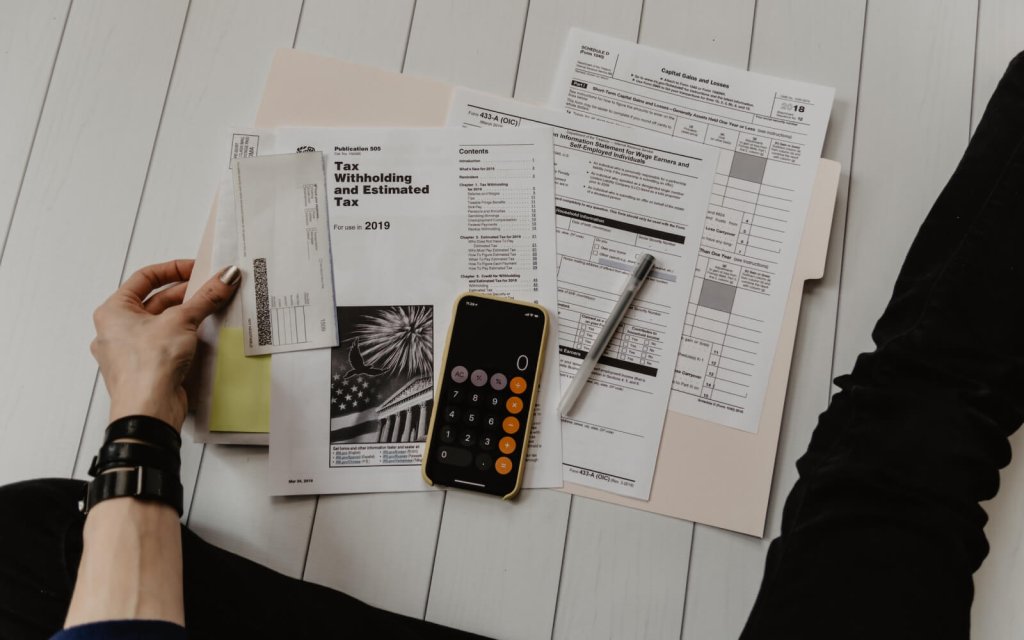

Mortgage

Setup a more convenient mortgage plan to buy properties with as low as 30% down payment of the actual market value of the property

Trusted by more than 75 global companies who have worked with us

We're proud to provide a place where people can be themselves - and it shows.

An affordable investment approach starts here.

It only takes 10 minutes to open an account.

Tell us about your goals.

Share a little about your

investment goals and we'll build

you a diverse mix of

exchange-traded funds (ETFs)

that line up.

Get your customized portfolio.

Go with our recommendation or

customize until you're

comfortable with the balance of

risk and return.

Start investing.

Once you select your

portfolio, we'll take it

from there. Just sit back

and track your progress

right from your

smartphone.

1k Project Done

Social Impact. Spark positive change

At Integrafintech we firmly believe it's our responsibility as corperate citizens to make a positive social impact on the world around us. This belief is embedded in the very fabric of our business and culture.

Our Social Impact Efforts

From promoting diversity and inclusion within our company to improving economic mobility in our local communities, our approach to social impact is multifaceted.

$58 million +

in Charitable Contributions over the last three years

Financial Products

Our Approach

Integrafintech has a legacy of continuity and certainty. Since 2008, we've weathered ups and downs of the market cycle with a tenured team that's been all in from the start.

Investment Attributes

Typical borrowers have a minimum revenue and EBITDA of $50 million and $10 million, respectively. However, the size of our real estate and asset-based lending borrowers varies greatly.

Portfolio Profile

Our diverse portfolio spans 100+ relationships and includes cash flow, real estate and asset-based loans ranging from $15 to $250 million.

High rating on Stockbrokers

"Innovative Business Solutions for Financial Company"

Frank Downing

Director of Research, Next Generation Internet